nh meals tax rate

Years ending on or after December 31 2026 NH ID rate is 2. The MR Tax is paid by the consumer and is collected and remitted to the State on the 15th of each month by.

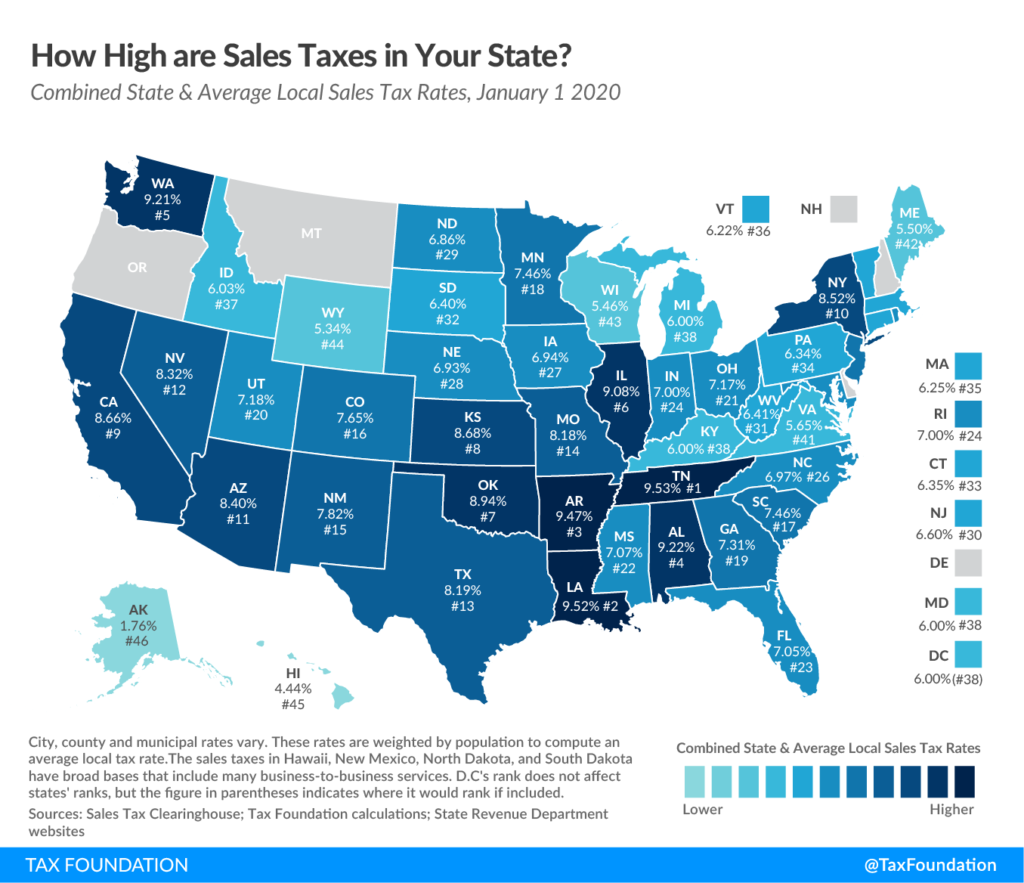

U S States With No Sales Tax Taxjar

Meals and Rooms Tax Where The Money Comers From TransparentNH.

. To ensure a smooth transition to the new tax rate we are reminding operators and taxpayers alike of this change. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Advertisement Its a change that was proposed by Gov.

Although the Department makes every effort to ensure the accuracy of data and information. Chris Sununu in this years budget package which passed state government in June. The current tax on NH Rooms and Meals is currently 9.

The Meals and Rentals MR Tax was enacted in 1967. NH Meals and Rooms Tax. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

The rate is reduced to 875 beginning on or after October 1 2021. 1350 per proof-gallon or 214 per 750ml 80-proof bottle. Starting October 1 2021 the New Hampshire Department of Revenue Administration NHDRA is decreasing the states Meals and Rooms Rentals Tax rate from 9 to 85.

There are however several specific taxes levied on particular services or products. 2022 New Hampshire state sales tax. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

The tax must be separately stated and separately charged on all invoices bills displays or contracts except on those solely for alcoholic beverages. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the customer receipt or check.

Concord NH The. Federal excise tax rates on beer wine and liquor are as follows. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates.

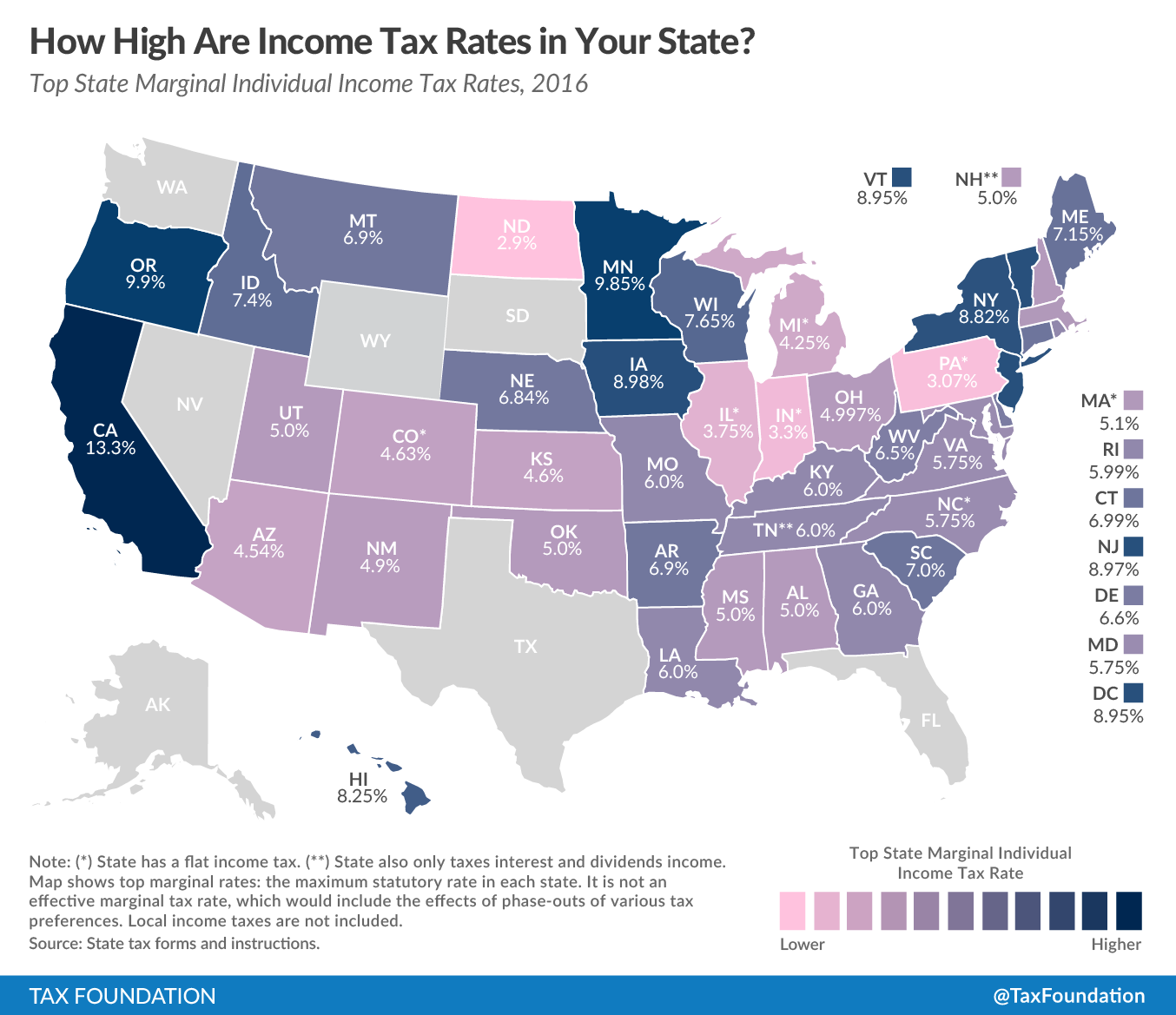

You only have to file a New Hampshire Income Tax Return if you have earned over 2400 annually 4800 for joint filers in taxable dividend and interest income. Filing options - Granite Tax Connect. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety.

Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only. Years ending on or after December 31 2025 NH ID rate is 3. New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals Tax ratewill decrease by 05 from 9 to 85.

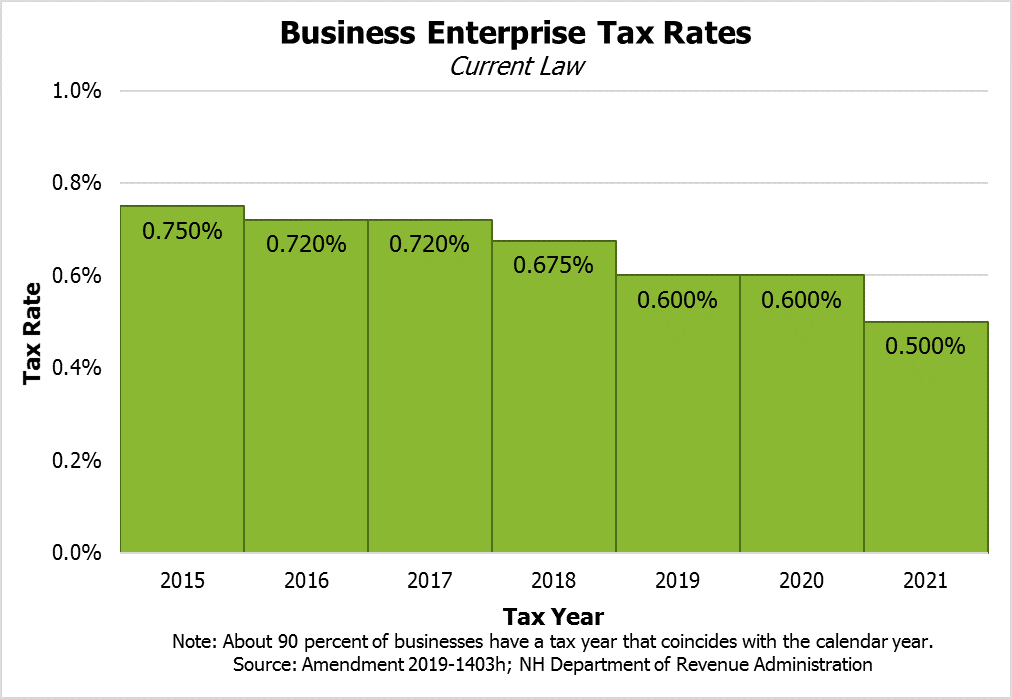

This budget helps small businesses by reducing the Business Enterprise Tax BET from 06 to 055. A 9 tax is also assessed on motor vehicle rentals. The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5.

1800 per 31-gallon barrel or 005 per 12-oz can. State Education Property Tax Warrant. Income tax is not levied on wages.

Some rates might be different in Exeter. Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting. Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting. New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85.

New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Vendors must add a 625 sales tax to the selling price of every meal and collect it from the purchaser.

Exact tax amount may vary for different items. The tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants as well as on motor vehicle rentals. 107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content.

The state meals and rooms tax is dropping from 9 to 85. A proof gallon is a gallon of. Years ending on or after December 31 2027 NH ID rate is 0.

Businesses register to collect meals tax with MassTaxConnect. Chapter 144 Laws of 2009 increased the rate from 8 to the current rate of 9. For additional assistance please call the Department of Revenue Administration at 603 230-5920.

New Hampshire is one of the few states with no statewide sales tax. The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered.

That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. This budget helps consumers by reducing the Meals and Rooms Tax from 9 to 85 its lowest level in over a decade. Increasing the percentage returned to towns means that even with the reduced rate towns will see an increase in the MR tax distribution.

Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals Tax rate will decrease by 05 from 9 to 85. Meals and Rentals Tax. Reducing our MR tax rate makes New Hampshire marginally more competitive with Maine and Vermont both of which have a 9 lodging tax.

Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases. Multiply this amount by 09 9 and enter the result on Line 2. Meals Rooms Rentals Tax Data.

New Hampshires individual tax rates apply to interest and dividend income only. Additional exemptions exist for seniors or disabled individuals. The Meals and Rooms Tax is assessed to customers of hotels restaurants or other businesses providing taxable meals room rentals and motor vehicle rentals.

New Hampshires sales tax rates for commonly exempted categories are listed below.

States With Highest And Lowest Sales Tax Rates

30 Glorious Street Foods From Around The World That Will Make You Want To Travel Fair Food Recipes World Street Food Best Street Food

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Tax Guide

Funding The State Budget Recent Trends In Business Taxes And Other Revenue Sources New Hampshire Fiscal Policy Institute

Utah S Recent Sales Tax Reform Efforts And Sales Taxes Across The Nation Utah Taxpayers

Claremont Announces Tax Rate Of 15 27 News Eagletimes Com

Sales Tax On Grocery Items Taxjar

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

New Hampshire Sales Tax Rate 2022

The Reserve Bank Of India Rbi Held Its Policy Rate At 7 25 Percent On Tuesday Pausing As Widely Expected After A Spike In Fo Supportive Japanese Yen Hold On

New Hampshire Meals And Rooms Tax Rate Cut Begins

A Glide Path To A 3 Percent Flat Income Tax Maciver Institute

Corporate Tax In The United States Wikiwand

Corporate Tax In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

New Hampshire Sales Tax Rate 2022

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation